Securing venture capital funding can be a transformative event for a startup, catapulting it from nascent idea to thriving enterprise. This journey, however, requires meticulous planning, a compelling narrative, and a deep understanding of the venture capital landscape. From crafting a persuasive pitch deck to navigating the complexities of due diligence and negotiation, this guide provides a comprehensive roadmap to successfully attracting the investment your business needs to flourish.

We’ll explore the various types of venture capital firms, the different funding stages, and the key elements of a successful funding application. We’ll also delve into the importance of networking, building strong relationships with potential investors, and effectively communicating your company’s vision and potential for growth. By understanding the intricacies of the process, you can significantly increase your chances of securing the funding necessary to achieve your business goals.

Understanding Venture Capital

Venture capital is a critical funding source for high-growth startups, offering substantial financial resources in exchange for equity. Understanding the nuances of venture capital, including the various types of firms, investment strategies, and funding stages, is crucial for entrepreneurs seeking this type of investment.

Types of Venture Capital Firms and Investment Strategies

Venture capital firms vary significantly in their size, investment focus, and strategies. Some specialize in early-stage investments, while others focus on later-stage growth capital. Their investment strategies also differ, with some taking a more hands-on approach, providing mentorship and operational support, while others adopt a more passive role. For instance, some firms might concentrate on specific industries, like biotechnology or software, allowing them to leverage industry expertise.

Others might adopt a broader approach, investing across various sectors. The investment strategy directly influences the type of companies they seek and the terms they offer.

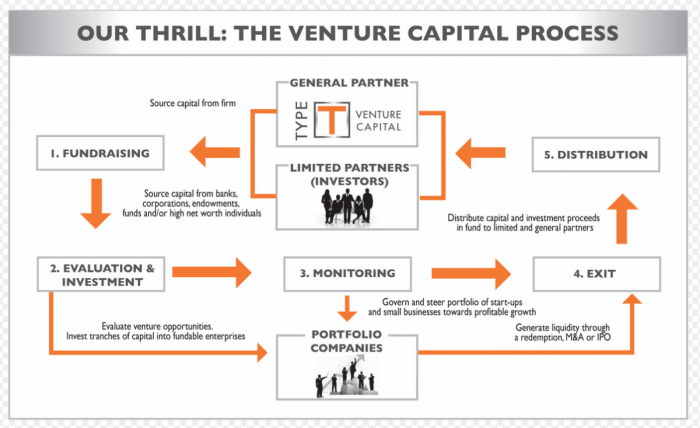

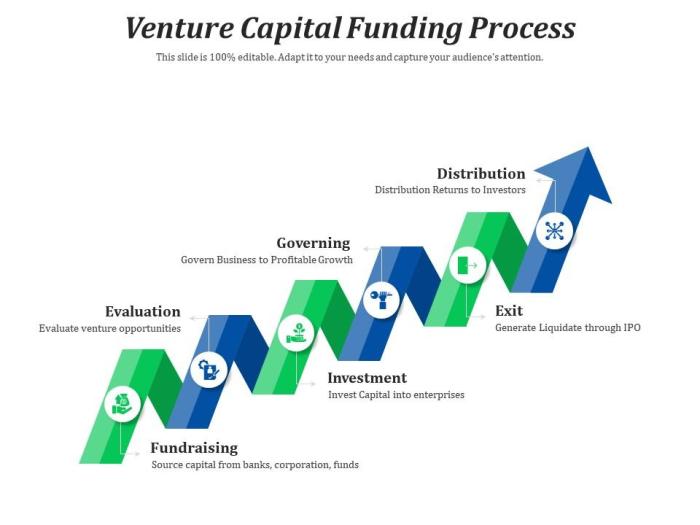

Stages of Venture Capital Funding

Venture capital funding typically occurs in several stages, each characterized by different investment amounts, investor expectations, and company milestones.

| Funding Stage | Typical Investment Amount | Investor Expectations | Company Milestones |

|---|---|---|---|

| Seed Funding | $100,000 – $2 million | Proof of concept, strong team, initial traction | Product development, initial customer acquisition |

| Series A | $2 million – $15 million | Market validation, revenue growth, scalable business model | Product-market fit, significant customer base, revenue generation |

| Series B | $10 million – $50 million | Demonstrated market leadership, strong financial performance, clear path to profitability | Expansion into new markets, significant revenue growth, established brand recognition |

| Series C and beyond | $50 million+ | Significant market share, substantial revenue, clear exit strategy | Further expansion, potential for IPO or acquisition |

Angel Investors versus Venture Capitalists

While both angel investors and venture capitalists provide funding to startups, they differ significantly in their investment approach, resources, and expectations. Angel investors are typically high-net-worth individuals who invest their own capital, often in early-stage companies. They frequently provide smaller amounts of funding compared to venture capitalists and often play a more hands-on role in mentoring and advising the startups they invest in.

Venture capitalists, on the other hand, manage large funds from institutional investors and typically invest larger sums in later-stage companies. Their investment decisions are often driven by a more formal due diligence process and they usually have a more defined exit strategy in mind. The key difference lies in the scale of investment and the level of involvement.

Angel investors often focus on smaller, early-stage investments with a higher risk tolerance, whereas VCs typically focus on later-stage, higher-growth companies with lower risk profiles, aiming for significant returns through an IPO or acquisition.

Preparing Your Pitch Deck

A well-structured and compelling pitch deck is crucial for securing venture capital funding. It serves as your primary communication tool, conveying your business idea, market opportunity, and team capabilities to potential investors in a concise and persuasive manner. A strong pitch deck isn’t just about presenting data; it’s about telling a story that resonates with investors and convinces them of your vision.

Sample Pitch Deck Structure

A typical pitch deck follows a logical progression, guiding investors through your business plan. While the specific sections may vary slightly depending on your industry and target audience, a standard structure generally includes the following:

- Cover Slide: Company name, logo, tagline, and presenter names/titles.

- Problem: Clearly define the problem your company solves and its market size. Include quantifiable data to demonstrate the significance of the problem.

- Solution: Describe your product or service and how it addresses the identified problem. Highlight key features and benefits.

- Market Opportunity: Analyze the target market, its size, and growth potential. Present market research data and projections to support your claims. For example, you might illustrate market size using a bar chart comparing your target market to competitors’ markets, showcasing a large and growing opportunity.

- Business Model: Explain how your company generates revenue and its key revenue streams. Include projections of revenue and profitability.

- Team: Introduce your team and highlight their relevant experience and expertise. Investors invest in people as much as in ideas.

- Traction: Showcase any early successes, such as user growth, revenue generation, or partnerships. This section demonstrates market validation and progress.

- Financials: Present key financial projections, including revenue, expenses, and profitability. Use clear and concise charts and graphs to illustrate your financial model. For example, a projected income statement showing steady growth over the next five years could be very effective.

- Funding Request: Specify the amount of funding you are seeking and how it will be used. Clearly Artikel your use of funds and the expected return on investment (ROI).

- Appendix (Optional): Include supporting documents such as market research reports, team resumes, or detailed financial projections.

Compelling Narrative and Market Analysis

A compelling narrative is essential to capture investors’ attention and maintain their interest throughout the presentation. The narrative should weave together the problem, solution, market opportunity, and your team’s ability to execute the plan. It should be a cohesive story, not just a collection of facts and figures. Similarly, a thorough market analysis demonstrates your understanding of the competitive landscape and the potential for success.

This analysis should include data on market size, growth rate, key competitors, and your competitive advantage. For example, a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) visually represented as a table can effectively communicate your competitive positioning.

Effective Visual Aids and Data Representations

Visual aids are crucial for conveying information clearly and concisely. Use charts, graphs, and images to illustrate key data points and make your presentation more engaging. Avoid overwhelming the audience with too much text. Instead, use visuals to highlight key findings and trends. For instance, a simple line graph showing user growth over time is far more effective than a paragraph describing the same data.

Similarly, a pie chart illustrating market share could clearly depict your company’s position within the industry.

Common Mistakes to Avoid

- Lack of a clear narrative: Failing to tell a cohesive story that connects the problem, solution, and market opportunity.

- Weak market analysis: Insufficient research and analysis of the target market and competitive landscape.

- Unrealistic financial projections: Overly optimistic or unsubstantiated financial forecasts.

- Poorly designed visuals: Using cluttered slides with too much text or confusing charts and graphs.

- Lack of focus: Trying to cover too much information in a short presentation.

- Ignoring the audience: Failing to tailor the presentation to the specific interests and concerns of venture capitalists.

- Not practicing the presentation: A poorly rehearsed presentation can undermine your credibility and effectiveness.

Building a Strong Business Plan

A comprehensive business plan is crucial for securing venture capital funding. It serves as a roadmap for your company’s growth, demonstrating your understanding of the market, your strategy for success, and your team’s capabilities. Investors use it to assess the viability and potential return on investment of your venture. A well-structured plan instills confidence and increases your chances of securing funding.

Essential Components of a Business Plan

A strong business plan includes several key components. These elements work together to paint a complete picture of your business, its market position, and its future prospects. A well-organized and clearly written plan is essential for conveying your vision effectively to potential investors.

- Executive Summary: A concise overview of your business, highlighting key aspects like the problem you solve, your solution, your target market, and your financial projections. It should be compelling enough to grab the investor’s attention and make them want to read further.

- Company Description: This section details your company’s mission, vision, and legal structure. It also Artikels your business model and how you plan to generate revenue.

- Market Analysis: A thorough analysis of your target market, including market size, growth potential, competitive landscape, and your unique value proposition. This demonstrates your understanding of the market dynamics and your ability to succeed within it.

- Organization and Management: This section showcases your team’s expertise and experience, highlighting the key personnel and their relevant skills. It should demonstrate the team’s ability to execute the business plan.

- Service or Product Line: A detailed description of your offerings, including their features, benefits, and competitive advantages. This section should clearly articulate the value proposition to the customer.

- Marketing and Sales Strategy: This section Artikels your plan for reaching your target market, including your marketing channels, sales tactics, and customer acquisition costs. A realistic and well-defined strategy is critical.

- Financial Projections: This crucial section presents your financial forecasts, including projected revenue, expenses, and profitability. It should include key metrics such as burn rate, customer acquisition cost, and lifetime value.

- Funding Request and Use of Funds: Clearly state the amount of funding you are seeking and how you intend to use the capital to achieve your goals. This demonstrates a clear understanding of your financial needs and how the investment will be utilized.

- Appendix: This section includes supporting documents, such as market research data, resumes of key personnel, and letters of support.

Importance of a Strong Financial Model and Projections

A robust financial model is the cornerstone of a convincing business plan. It provides a realistic and detailed forecast of your company’s financial performance, allowing investors to assess the potential return on their investment. Inaccurate or unrealistic projections can severely damage your credibility. The model should demonstrate a clear path to profitability and sustainability. For example, a SaaS company might project recurring revenue based on customer acquisition and churn rates, demonstrating a predictable and scalable business model.

A strong model should also include sensitivity analysis to show how changes in key assumptions might affect the overall results.

Articulating Your Team’s Expertise and Experience

Investors invest in people as much as they invest in ideas. Highlighting your team’s relevant experience and expertise is crucial. This section should showcase the team’s track record of success, their relevant skills, and their commitment to the venture. Include detailed biographies of key personnel, emphasizing their accomplishments and experience in relevant fields. For example, a team with a proven history of developing successful technology products will be more attractive to investors than a team with limited experience.

Examples of Market Research Data That Impress Venture Capitalists

Venture capitalists look for data-driven insights. Impress them with compelling market research that validates your assumptions and demonstrates the size and potential of your target market. Examples include:

- Market Size and Growth Rate: Provide data from reputable sources like industry reports, market research firms (e.g., Statista, IBISWorld), and government statistics to demonstrate the market’s size and growth potential. For example, stating that the market for [specific product/service] is expected to grow at a CAGR of X% over the next Y years, based on data from [source], is far more impactful than a general statement.

- Competitive Landscape Analysis: Identify your key competitors and analyze their strengths and weaknesses. Demonstrate your understanding of the competitive landscape and how your product or service differentiates itself from the competition. A Porter’s Five Forces analysis can be a valuable tool here.

- Customer Segmentation and Targeting: Clearly define your target customer segments and explain why you are focusing on these specific groups. Include data on the size and characteristics of your target market, as well as your strategy for reaching them.

- Customer Acquisition Cost (CAC) and Lifetime Value (LTV): Present realistic projections for your CAC and LTV, demonstrating your understanding of the cost of acquiring customers and the long-term value they will bring to your business. A high LTV relative to CAC is a very positive signal for investors.

Networking and Reaching Out to VCs

Securing venture capital funding often hinges on effectively networking and directly engaging with venture capitalists (VCs). Building relationships and presenting your business compellingly are crucial steps in this process. This section Artikels key strategies for identifying suitable VC firms, connecting with them, and following up on your initial contact.

Identifying Key Networking Events and Strategies

Strategic networking is paramount in the VC world. Attending industry conferences, relevant workshops, and even smaller, niche events can provide invaluable opportunities to meet VCs and other industry professionals. These events often feature panels, presentations, and networking sessions specifically designed to facilitate connections between entrepreneurs and investors. For example, attending industry-specific conferences like TechCrunch Disrupt or Collision provides access to a large pool of VCs actively seeking investment opportunities.

Moreover, joining relevant professional organizations and participating in their events can cultivate relationships with potential investors within your industry sector. Online platforms, such as LinkedIn, can also be used to identify and connect with VCs, but personalized outreach is often more effective than simply sending generic connection requests. Active participation in online forums and discussions related to your industry can also enhance your visibility and create opportunities for meaningful engagement.

Researching and Identifying Suitable VC Firms

Before reaching out, thorough research is vital. Identifying VC firms whose investment focus aligns with your business model and stage of development significantly increases your chances of securing funding. Resources such as Crunchbase and PitchBook provide detailed information on VC firms, including their investment history, portfolio companies, and areas of expertise. Analyzing their past investments helps you understand their preferences and determine if your business is a good fit.

For example, if your company is developing a new AI-powered healthcare solution, focusing on VC firms with a history of investing in similar ventures will improve your chances of a positive response. Consider factors like the firm’s typical investment size, stage of investment (seed, Series A, etc.), and industry focus when selecting potential investors.

Submitting a Proposal and Pitching to a VC Firm

Once you’ve identified suitable VC firms, preparing a compelling pitch deck and business plan is essential. The pitch deck should concisely communicate your business’s value proposition, market opportunity, team, and financial projections. It serves as a high-level overview, sparking interest and leading to more in-depth discussions. Following the submission of your pitch deck, you might be invited to a formal pitch meeting.

This is where you’ll present your business plan in detail, addressing questions from the VCs. Practicing your pitch beforehand is crucial, ensuring a confident and persuasive delivery. The process often involves multiple meetings, potentially with different partners within the firm. Remember to always be prepared to answer tough questions about your business model, market analysis, and financial projections.

A well-structured pitch, delivered with conviction and a clear understanding of your business, significantly enhances your chances of success.

Following Up After Initial Contact

Following up after initial contact is crucial for maintaining momentum. A timely and professional follow-up email reiterating your interest and highlighting any new developments within your company can help keep your proposal top-of-mind. Avoid excessive follow-ups, but a well-timed email a week or two after your initial contact is generally appropriate. If you haven’t heard back after a reasonable timeframe, a brief and polite follow-up is acceptable.

Remember to personalize your communication, demonstrating your genuine interest in the firm and their investment portfolio. Maintaining consistent, professional communication throughout the process showcases your commitment and professionalism, increasing the likelihood of a successful outcome.

Due Diligence and Negotiation

Securing venture capital funding is a significant milestone for any startup, but the process doesn’t end with a promising pitch. Due diligence and subsequent negotiations are crucial stages that determine the final terms of the investment and lay the foundation for a successful investor-company relationship. Understanding these phases is essential for maximizing the benefits and mitigating potential risks.

Venture capitalists conduct thorough due diligence to assess the viability and potential of the investment opportunity. This involves a comprehensive review of various aspects of the business, including financial performance, market analysis, management team capabilities, intellectual property, and legal compliance. The process is designed to minimize risk and validate the information presented in the business plan and pitch deck.

Venture Capital Due Diligence Process

The due diligence process typically involves several key phases. Initially, VCs will focus on a high-level review of the business plan and financial projections, followed by a deeper dive into specific areas based on their initial findings. This might include financial audits, legal reviews, customer interviews, and technical assessments. The level of scrutiny will vary depending on the investment size and the stage of the company.

For example, a Series A round might involve a more extensive due diligence process than a seed round. The aim is to uncover any potential red flags or inconsistencies that could impact the investment decision. This thorough examination is vital in ensuring the VC’s investment is well-informed and strategically sound.

Negotiation Points and Strategies

Negotiations between the startup and the VC firm center around key terms Artikeld in the term sheet. These terms typically include valuation, equity stake, investment amount, liquidation preferences, board representation, and anti-dilution protection. Strong negotiation strategies involve understanding the VC’s investment thesis and priorities, preparing a well-defined valuation range based on comparable companies, and having a clear understanding of your company’s strengths and weaknesses.

Successful negotiations often require a balance between securing favorable terms and maintaining a positive relationship with potential investors. Compromise is often necessary to reach an agreement that benefits both parties. For instance, a company might concede on board representation in exchange for a higher valuation.

Types of Term Sheets and Their Implications

Term sheets are not legally binding contracts, but they Artikel the key terms of the investment. Different types of term sheets exist, each with its own implications. A convertible note, for example, is often used in early-stage funding and converts into equity at a later stage. This provides flexibility for both the investor and the company. A priced round, on the other hand, sets a fixed valuation at the time of investment.

The choice of term sheet depends on the stage of the company, the investor’s preferences, and the overall market conditions. Each type presents unique advantages and disadvantages that need careful consideration. Understanding these nuances is crucial for navigating the funding process effectively. For instance, a convertible note may be preferable for a company with high uncertainty in its valuation, while a priced round is more suitable for a company with a more established track record.

Managing Investor Relations Post-Funding

Maintaining a strong relationship with investors is crucial for long-term success. Regular communication, transparent reporting, and proactive updates on key milestones are essential. Investors want to see progress and be assured that their investment is being managed effectively. This ongoing communication fosters trust and ensures a collaborative partnership. Establishing clear communication channels and reporting protocols from the outset helps to manage expectations and build a strong investor relationship.

Proactive communication, even when encountering challenges, demonstrates transparency and builds confidence. Regular board meetings and financial updates are key components of this ongoing dialogue.

Illustrative Examples of Successful Funding Rounds

Securing venture capital requires a compelling business plan, a strong team, and a clear path to profitability. Examining successful funding rounds offers valuable insights into the strategies and characteristics that attract investor interest. The following case studies illustrate diverse approaches to securing substantial funding.

Case Studies of Successful Venture Capital Funding

The following examples showcase companies that successfully navigated the venture capital landscape, highlighting their unique strategies and achievements. Each case study offers a different perspective on building a successful pitch and securing investment.

| Company Name | Industry | Funding Amount (Approximate) | Key Success Factors |

|---|---|---|---|

| Airbnb | Hospitality | Over $6 billion (across multiple rounds) | Disruptive business model addressing a significant market need (convenient and affordable accommodation), strong network effects, and a highly scalable platform. Exceptional execution and adaptation to market changes also played a crucial role. |

| Stripe | Fintech | Over $2 billion (across multiple rounds) | Focus on solving a critical pain point for businesses (online payment processing), a robust and reliable technology platform, and a strong team with deep technical expertise. The company’s emphasis on developer experience and ease of integration contributed significantly to its success. |

| Spotify | Music Streaming | Over $1 billion (across multiple rounds) | First-mover advantage in a rapidly growing market, a compelling user experience, and a strong focus on building a large user base. The company’s ability to secure exclusive content deals and negotiate favorable licensing agreements were key to its success. The strategic decision to offer a freemium model played a pivotal role in acquiring a large user base. |

Successfully navigating the world of venture capital requires a combination of strategic planning, compelling communication, and unwavering perseverance. By meticulously preparing your pitch deck, developing a robust business plan, and actively networking with potential investors, you can significantly increase your chances of securing the funding necessary to propel your business forward. Remember, securing venture capital is not just about the money; it’s about finding the right partners who share your vision and can provide valuable guidance and support as you scale your business.

This guide provides a strong foundation for this journey, equipping you with the knowledge and tools to confidently pursue your funding goals.

Expert Answers

What is a term sheet, and why is it important?

A term sheet is a non-binding agreement outlining the key terms and conditions of a venture capital investment. It’s crucial because it sets the stage for the final legal agreement, protecting both the investor and the company.

How long does the entire VC funding process typically take?

The process can vary significantly, but it generally takes several months, from initial contact to securing funding. Factors like deal complexity and investor due diligence can influence the timeline.

What are some common reasons why VC firms reject funding requests?

Common reasons include a weak business plan, unrealistic projections, a lack of a strong management team, inadequate market analysis, and insufficient traction or evidence of market demand.

How can I improve my chances of securing follow-on funding (Series B, C, etc.)?

Demonstrate strong performance against previous milestones, achieve significant growth, maintain a healthy financial position, and clearly articulate your future plans and growth strategy.

What is the role of a legal advisor during the VC funding process?

A legal advisor is crucial for reviewing and negotiating the term sheet and final investment agreement, protecting your company’s interests and ensuring compliance with all legal requirements.