Navigating the financial landscape of a small business can be challenging, but the right accounting software can transform the experience. This guide delves into the world of small business accounting software, exploring its essential features, selection process, implementation strategies, and future trends. We’ll cover everything from choosing the right software based on your specific needs to ensuring data security and maximizing the return on your investment.

Whether you’re a sole proprietor or a growing LLC, understanding how to leverage accounting software is crucial for success.

From streamlining invoicing and expense tracking to generating insightful financial reports and forecasting future performance, the benefits of employing the right accounting software are numerous. This guide aims to equip you with the knowledge and understanding necessary to make informed decisions, ultimately improving your business’s financial health and efficiency.

Defining Small Business Accounting Software Needs

Selecting the right accounting software is crucial for the success of any small business. The software should streamline financial management, improve accuracy, and provide valuable insights for informed decision-making. The ideal choice depends heavily on the specific needs of the business, which vary significantly based on factors like business structure, industry, and anticipated growth.

Core Accounting Functions for Different Business Structures

Sole proprietorships, partnerships, and LLCs all require core accounting functions, but the complexity and specific needs differ. Sole proprietorships often utilize simpler software focused on income and expense tracking, while partnerships and LLCs may require more advanced features to manage multiple owner accounts and distributions. All three structures benefit from features like invoicing, expense tracking, financial reporting, and bank reconciliation.

More complex structures might also require features for managing payroll and inventory.

Accounting Needs Across Industries

Different industries have unique accounting requirements. Retail businesses, for example, need robust inventory management systems, point-of-sale (POS) integration, and sales tax calculations. Service businesses may focus more on time tracking, project management, and invoicing for client services. Manufacturing businesses require more complex inventory tracking, cost accounting, and potentially manufacturing resource planning (MRP) capabilities. The software’s ability to adapt to these specific industry needs is paramount.

Scalability and Future Growth

Choosing scalable accounting software is essential for long-term success. As a small business grows, its accounting needs will inevitably become more complex. Software that can easily accommodate increased transaction volume, more complex reporting requirements, and the addition of new users or features will save time and resources in the long run. For example, a small retail business that anticipates opening multiple locations needs software capable of managing inventory across multiple stores and generating consolidated financial reports.

Comparison of Accounting Software Categories

The following table compares features of different accounting software categories:

| Feature | Cloud-Based | Desktop | Mobile |

|---|---|---|---|

| Accessibility | Accessible from anywhere with internet connection | Requires local installation; limited accessibility | Accessible on mobile devices; limited features compared to desktop/cloud |

| Cost | Typically subscription-based; variable cost depending on features | One-time purchase; potential for ongoing maintenance costs | Often integrated with desktop/cloud versions; may have separate subscription fees |

| Data Security | Data stored on secure servers; provider responsibility for backups and security | Data stored locally; user responsible for backups and security | Data security depends on integration with desktop/cloud versions |

| Scalability | Generally highly scalable; easily adapts to changing business needs | Scalability can be limited; may require upgrades or replacements | Limited scalability; often serves as a supplemental tool |

Key Features of Small Business Accounting Software

Choosing the right accounting software can significantly streamline your business operations and improve financial management. The ideal software will offer a comprehensive suite of tools designed to handle various aspects of your finances, from invoicing to reporting. This section details the essential features that constitute robust small business accounting software.

Invoicing and Billing Modules

Effective invoicing and billing are crucial for timely payments and maintaining a healthy cash flow. Essential features within this module include customizable invoice templates (allowing for branding and professional presentation), automated invoice generation (saving time and reducing errors), online payment processing integration (facilitating quick and convenient payments from clients), tracking of outstanding invoices (monitoring payments due and identifying overdue accounts), and the ability to generate reports summarizing invoicing activity (providing insights into sales trends and payment patterns).

For example, a well-designed system might allow you to easily send invoices via email, track payments online, and automatically generate reminders for overdue invoices.

Expense Tracking and Reporting Capabilities

Accurate expense tracking is fundamental to understanding your business’s profitability and identifying areas for cost reduction. Robust expense tracking modules allow for easy recording of expenses, categorization for analysis (e.g., by type, project, or department), the ability to attach supporting documentation (such as receipts), and automated expense reports (providing summaries of expenses over specified periods). These reports can then be used to identify trends, manage budgets, and prepare tax filings.

For instance, a business owner might use expense tracking to analyze marketing costs and determine which campaigns are yielding the best return on investment.

Integrated Payroll Processing Functionalities

Streamlining payroll processing is vital for compliance and employee satisfaction. Integrated payroll features offer significant advantages. These include automated calculations of employee wages, deductions, and taxes, direct deposit capabilities (reducing manual processing and ensuring timely payments), generation of payroll reports and tax forms (facilitating compliance with relevant regulations), and the ability to manage employee information (such as contact details and tax withholding information).

A system that integrates payroll with other accounting functions can automatically update financial statements, reducing the risk of errors and inconsistencies.

Financial Reporting and Analysis Tools

Comprehensive financial reporting is essential for informed decision-making. Robust accounting software provides various reporting tools, including profit and loss statements (showing revenue, expenses, and net income), balance sheets (presenting assets, liabilities, and equity), cash flow statements (tracking the movement of cash in and out of the business), and customized reports (allowing for tailored analysis based on specific needs). For example, a business owner could use these reports to track profitability over time, assess the financial health of the business, and make informed decisions about investments or expansion.

These reports should be easily exportable in various formats (PDF, CSV, etc.) for sharing with stakeholders.

Financial Forecasting and Budgeting Features

Effective financial forecasting and budgeting are critical for long-term planning and financial stability. Key features to support this include tools for creating budgets based on historical data and projections, scenario planning capabilities (allowing for analysis of different financial outcomes under varying conditions), performance tracking against budget (monitoring progress and identifying areas requiring adjustments), and forecasting tools that project future revenue and expenses (providing insights into potential financial performance).

For instance, a small business might use forecasting tools to predict sales for the next quarter, based on past performance and anticipated market trends. This allows them to plan for staffing, inventory, and other expenses accordingly.

- Budget creation and management tools

- Scenario planning and “what-if” analysis

- Sales forecasting and revenue projections

- Expense forecasting and cost control tools

- Cash flow forecasting and management

Software Selection and Implementation

Choosing and implementing the right accounting software is crucial for a small business’s financial health and operational efficiency. The process involves careful consideration of various factors, from pricing models to software integration with existing business tools. A well-planned implementation minimizes disruption and maximizes the software’s benefits.

Pricing Models: Subscription vs. One-Time Purchase

Small businesses have a choice between subscription-based and one-time purchase models for accounting software. Subscription models typically involve recurring monthly or annual fees, providing access to ongoing updates, support, and sometimes additional features. One-time purchases offer upfront cost certainty but may lack regular updates and ongoing support, potentially leading to compatibility issues or security vulnerabilities in the long run.

The optimal choice depends on the business’s budget, technical expertise, and long-term needs. For instance, a rapidly growing business might benefit from a subscription model to accommodate changing needs, while a small, stable business might find a one-time purchase more cost-effective.

Evaluating Software User-Friendliness and Ease of Use

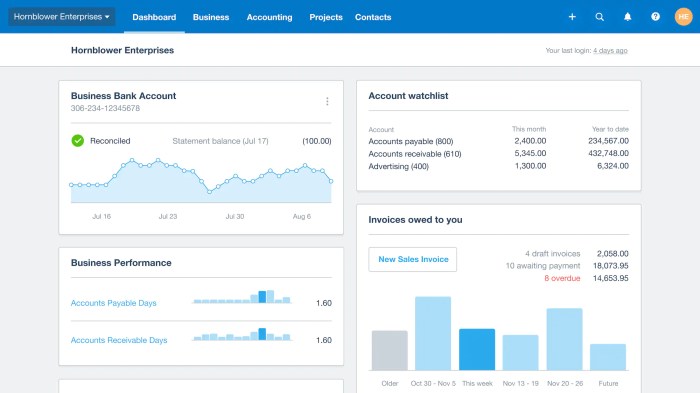

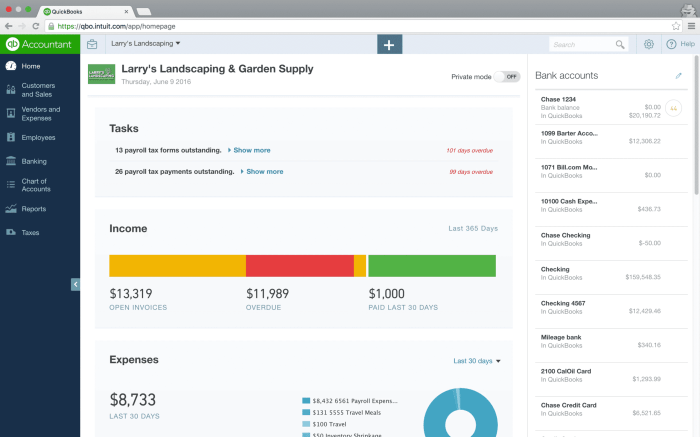

Assessing user-friendliness is critical for successful software adoption. This involves considering factors such as intuitive navigation, clear interface design, and comprehensive documentation. A trial period, if offered, is invaluable for hands-on evaluation. Look for software with features like clear dashboards, easy report generation, and readily available help resources. For example, a software with drag-and-drop functionality and context-sensitive help menus would be considered more user-friendly than one requiring extensive technical knowledge or complex command lines.

Consider also the training resources offered by the vendor – comprehensive training materials and readily available support can significantly improve user experience and reduce the learning curve.

Step-by-Step Implementation Guide

Implementing accounting software involves a structured approach. First, thoroughly review the software’s features and functionalities to ensure they meet the business’s specific needs. Next, plan the data migration process, carefully backing up existing financial data before transferring it to the new software. This might involve importing data from spreadsheets or other accounting systems. Then, configure the software to reflect the business’s chart of accounts, tax settings, and other relevant parameters.

Finally, thoroughly test the software to identify and rectify any errors before fully transitioning to the new system. Regular training sessions for employees using the software are also vital for smooth operation. Consider creating a detailed implementation checklist to track progress and ensure all steps are completed.

Integrating Accounting Software with Other Business Tools

Integrating accounting software with other business tools like CRM (Customer Relationship Management) and e-commerce platforms streamlines workflows and improves data accuracy. Many accounting software solutions offer APIs (Application Programming Interfaces) or built-in integrations that facilitate data exchange with other applications. For example, integrating an e-commerce platform with accounting software automatically records sales transactions, eliminating manual data entry and reducing the risk of errors.

Similarly, integrating a CRM system allows for better tracking of customer payments and facilitates more accurate financial forecasting. When selecting software, investigate the availability of integrations with existing or planned business tools. A robust integration capability ensures seamless data flow and operational efficiency.

Data Security and Compliance

Protecting your financial data is paramount for any small business. Accounting software holds sensitive information, making data security and compliance crucial for maintaining operational integrity, avoiding legal penalties, and preserving your business reputation. Robust security measures and adherence to relevant regulations are not just good practice; they are essential for long-term success.Data security involves safeguarding your financial information from unauthorized access, use, disclosure, disruption, modification, or destruction.

This includes protecting sensitive data like customer information, bank details, tax records, and payroll information. Backup procedures are equally vital, providing a safety net against data loss due to hardware failure, software glitches, cyberattacks, or natural disasters. Regular backups, stored securely offsite, are essential to ensure business continuity and data recovery in case of unforeseen events.

Compliance Requirements for Financial Data

Compliance with relevant regulations is non-negotiable. These regulations vary depending on your location, industry, and the type of data you handle. For example, businesses handling protected health information (PHI) must comply with the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Similarly, companies operating within the European Union must adhere to the General Data Protection Regulation (GDPR), which focuses on the protection of personal data.

Failure to comply can result in significant fines and reputational damage. Understanding and adhering to these regulations is crucial for protecting your business and your clients.

Choosing Software that Meets Industry-Specific Compliance Standards

Selecting accounting software that inherently incorporates security features and complies with relevant regulations is a critical step. Look for software that offers features like data encryption both in transit and at rest, multi-factor authentication, access controls, and audit trails. When evaluating software, specifically inquire about their compliance certifications and security protocols. For example, a software provider claiming HIPAA compliance should be able to provide documentation demonstrating their adherence to HIPAA’s security rule.

Similarly, GDPR compliance should be demonstrable through adherence to data processing principles, data subject rights, and appropriate technical and organizational measures.

Security Measures Implemented by Reputable Accounting Software Providers

Reputable accounting software providers invest heavily in security infrastructure and practices. Examples of common security measures include:

- Data Encryption: Protecting data both while it’s being transmitted (in transit) and while it’s stored (at rest) using strong encryption algorithms like AES-256.

- Multi-Factor Authentication (MFA): Requiring multiple forms of authentication (password, one-time code, biometric scan) to access the software, significantly reducing the risk of unauthorized access.

- Access Controls: Implementing role-based access control (RBAC) to restrict access to sensitive data based on user roles and responsibilities. This ensures that only authorized personnel can access specific information.

- Regular Security Audits and Penetration Testing: Conducting regular security assessments to identify and address vulnerabilities before they can be exploited by malicious actors.

- Data Backup and Disaster Recovery: Employing robust backup and recovery procedures to ensure business continuity in the event of data loss or system failure. This often involves offsite backups and disaster recovery plans.

- Compliance Certifications: Obtaining relevant industry certifications (e.g., SOC 2, ISO 27001) to demonstrate a commitment to security best practices and compliance standards.

Training and Support

Effective training and readily available support are crucial for the successful adoption and utilization of small business accounting software. A well-structured training program, coupled with responsive technical assistance, ensures users can confidently manage their financial data and maximize the software’s capabilities. This leads to increased efficiency, reduced errors, and better financial decision-making.Effective training methods should cater to diverse learning styles and technical proficiency levels.

A multi-faceted approach is generally most effective.

Effective Training Methods

A combination of methods ensures comprehensive understanding and skill development. These methods should be tailored to the specific software and the users’ experience levels. For example, beginner training should focus on fundamental tasks, while advanced training could cover more complex features like custom reporting or integrations with other business tools.

- Instructor-led training: Interactive sessions, either in-person or virtual, allow for direct interaction with an instructor and immediate clarification of doubts. This approach is particularly useful for complex functionalities or for users who prefer a hands-on learning experience.

- Self-paced online tutorials: Video tutorials and online documentation provide flexibility and allow users to learn at their own pace. This is ideal for users who prefer independent learning and can revisit specific sections as needed.

- Interactive simulations and exercises: Practical exercises using sample data allow users to apply their knowledge and reinforce their understanding. These exercises should mimic real-world scenarios to enhance the learning experience.

- On-demand webinars and workshops: Scheduled webinars and workshops on specific topics, such as advanced reporting or payroll processing, provide opportunities for users to deepen their knowledge and learn best practices.

Resources for Technical Support and Troubleshooting

Access to reliable technical support is essential for resolving issues and ensuring smooth operation. Several avenues should be available to users.

- Software vendor’s help desk: Most software vendors offer phone, email, or chat support. This is often the first point of contact for resolving technical issues.

- Online knowledge base or FAQ section: A comprehensive online resource with frequently asked questions, troubleshooting guides, and tutorials can help users find solutions independently.

- Community forums or user groups: Connecting with other users can provide valuable insights and solutions to common problems. Many software vendors foster online communities where users can share experiences and help each other.

- Third-party support services: Some businesses opt for third-party support providers who specialize in providing technical assistance for specific software packages.

Importance of Ongoing Training

Software updates and enhancements are frequent. Ongoing training is crucial to keep users abreast of new features and functionalities, improving efficiency and maximizing the return on investment.Regular updates can include short online modules, newsletters, or webinars focusing on new features, improved workflows, or best practices for using the software. These updates should be readily available and easily accessible to users.

For example, a quarterly webinar on new features and updates can keep users informed and engaged. A monthly newsletter can provide tips and tricks for optimizing software usage.

Sample Training Module for New Users

This module focuses on the core functionalities needed to manage basic accounting tasks.

Module 1: Getting Started

This section introduces the software interface, navigation, and basic setup procedures. It covers logging in, customizing preferences, and understanding the main dashboard. It includes a guided tour of the software interface and a series of short, interactive exercises.

Module 2: Data Entry and Management

This section covers entering financial transactions, including invoices, expenses, and payments. It emphasizes accurate data entry and best practices for maintaining organized financial records. It includes practical exercises on creating invoices, recording expenses, and reconciling bank statements.

Module 3: Generating Reports

This section focuses on creating and interpreting basic financial reports, such as profit and loss statements and balance sheets. It explains how to use the software’s reporting tools to generate customized reports and analyze financial performance. It includes exercises on generating various reports and interpreting key financial metrics.

Module 4: Basic Payroll (if applicable)

This section covers the basics of payroll processing, including setting up employee information, calculating wages, and generating payroll reports. It will include information on tax withholdings and compliance requirements (note: this requires specific legal and tax advice and should not be considered comprehensive).

Cost-Benefit Analysis

Investing in small business accounting software requires careful consideration of costs and benefits. A thorough cost-benefit analysis helps justify the expense and ensures the chosen software aligns with your business needs and budget. This analysis compares the total cost of implementing and using the software against the anticipated financial and operational advantages it will provide.

Conducting a Cost-Benefit Analysis

A cost-benefit analysis involves systematically identifying and quantifying all relevant costs and benefits associated with software implementation. This process typically begins with listing all direct and indirect costs, such as software licensing fees, implementation costs (including training and data migration), ongoing maintenance fees, and potential costs of integration with other business systems. Benefits are then identified and valued, encompassing both tangible (e.g., reduced labor costs) and intangible benefits (e.g., improved decision-making).

Finally, the net present value (NPV) or return on investment (ROI) is calculated to determine the financial viability of the investment. A positive NPV or a high ROI suggests the investment is worthwhile.

Potential Cost Savings

Implementing accounting software can lead to significant cost savings in several areas. Automation of tasks like invoice generation, accounts payable and receivable management, and bank reconciliation reduces the time spent on manual data entry and processing, freeing up employee time for more strategic activities. This translates to direct labor cost savings. Furthermore, improved accuracy reduces errors and minimizes the costs associated with correcting mistakes, such as late payment penalties or discrepancies in financial reporting.

The software’s ability to generate accurate and timely reports also streamlines tax preparation, potentially reducing professional accounting fees.

Tangible and Intangible Benefits

Tangible benefits are easily quantifiable and measurable, such as reduced labor costs, decreased errors, and lower professional fees. For example, a small business might save $500 per month in labor costs by automating invoice processing. Intangible benefits are more difficult to quantify but equally important. Improved accuracy and timely financial reporting enhance decision-making, allowing for better resource allocation and strategic planning.

Enhanced data security and compliance reduce the risk of financial losses and legal penalties. Improved efficiency and streamlined workflows lead to increased productivity and a more positive work environment.

Cost and Benefit Comparison of Software Options

The following table compares the costs and benefits of three hypothetical accounting software options: SimpleAccount, BusinessWise, and ProFinance. Note that these are illustrative examples and actual costs and benefits will vary depending on the specific software and business needs.

| Feature | SimpleAccount | BusinessWise | ProFinance |

|---|---|---|---|

| Software License (Annual) | $200 | $500 | $1000 |

| Implementation Costs | $100 | $300 | $500 |

| Annual Maintenance | $50 | $100 | $200 |

| Estimated Annual Labor Savings | $500 | $1000 | $1500 |

| Improved Reporting Efficiency | Moderate | High | Very High |

| Data Security Features | Basic | Enhanced | Advanced |

Future Trends in Small Business Accounting Software

The landscape of small business accounting software is constantly evolving, driven by technological advancements and the changing needs of entrepreneurs. Increasingly sophisticated tools are emerging, promising greater efficiency, accuracy, and accessibility for businesses of all sizes. This section will explore several key trends shaping the future of this vital software category.

AI Integration and Automation

Artificial intelligence (AI) is rapidly transforming various sectors, and small business accounting is no exception. AI-powered features are already appearing in many accounting software packages, automating tasks such as invoice processing, expense categorization, and even basic financial forecasting. For example, some systems can automatically scan and extract data from receipts, eliminating manual data entry. This automation not only saves time but also reduces the risk of human error, leading to more accurate financial records.

More advanced AI features are being developed that can provide real-time insights into a business’s financial health, helping owners make better informed decisions.

The Impact of Cloud Computing

Cloud computing has revolutionized the way small businesses access and manage their accounting software. Cloud-based solutions offer several key advantages over traditional, on-premise software. These include accessibility from anywhere with an internet connection, automatic software updates, reduced IT infrastructure costs, and enhanced data security through robust cloud providers’ security measures. Companies like Xero and QuickBooks Online are prime examples of how cloud-based accounting software has become the norm for many small businesses, offering scalability and flexibility to adapt to business growth.

Benefits of Mobile Accounting Applications

The increasing use of mobile devices has led to the development of mobile accounting applications designed for on-the-go access. These apps allow business owners to check their financial status, approve invoices, and manage expenses from anywhere, at any time. The convenience and accessibility provided by mobile apps are particularly beneficial for entrepreneurs who are frequently on the move or work remotely.

Mobile apps often integrate seamlessly with their desktop counterparts, ensuring data consistency across all platforms. For instance, a business owner could approve an invoice using a mobile app while traveling and the approval would immediately update the main accounting system.

Predictions for Future Development

Several key predictions can be made about the future development of small business accounting software. We can anticipate a continued increase in AI-driven automation, with even more tasks becoming automated. Integration with other business tools, such as CRM and e-commerce platforms, will also become more sophisticated, creating a more streamlined workflow. The rise of blockchain technology could also impact accounting software, offering enhanced security and transparency in financial transactions.

Finally, personalized financial advice and insights, powered by AI and machine learning, are likely to become more prevalent, providing small business owners with data-driven guidance to improve their financial management. For example, software might predict cash flow shortages based on historical data and spending patterns, allowing proactive adjustments.

Implementing the right small business accounting software is a strategic move that can significantly impact your business’s success. By carefully considering your needs, evaluating various software options, and prioritizing data security and ongoing training, you can harness the power of technology to manage your finances effectively. This guide has provided a framework for this process, empowering you to choose a solution that streamlines operations, improves financial clarity, and fosters sustainable growth.

Remember to regularly review and adapt your software choices as your business evolves.

Helpful Answers

What is the difference between cloud-based and desktop accounting software?

Cloud-based software is accessed online and data is stored remotely, offering accessibility from anywhere with an internet connection. Desktop software is installed on your computer and data is stored locally. Cloud-based options generally require a subscription fee, while desktop software often involves a one-time purchase.

How much should I expect to pay for small business accounting software?

Pricing varies greatly depending on features, scalability, and vendor. Expect to find options ranging from free (with limited features) to several hundred dollars per month for comprehensive solutions. Consider your business’s size and needs when budgeting.

What are some common mistakes to avoid when choosing accounting software?

Common mistakes include failing to consider future scalability, neglecting user-friendliness, overlooking data security, and not adequately researching different options before committing. Thorough research and planning are key.

How can I ensure the security of my financial data in the chosen software?

Choose software with robust security features like encryption, two-factor authentication, and regular data backups. Understand the provider’s data security policies and ensure compliance with relevant regulations (e.g., HIPAA, GDPR).

What kind of support should I expect from the software provider?

Reputable providers offer various support options, including phone support, email support, online help resources, and potentially even live chat. Consider the availability and responsiveness of support before making a purchase.